6 IMPORTANT TYPES OF FINANCIAL MODELS

Unlocking Financial Mastery with Finaim – The Best Financial Modeling Coaching in Delhi

Financial modeling is the heartbeat of modern finance—whether it’s evaluating companies, pricing options, or navigating mergers and acquisitions. In a world driven by data and strategy, mastering the right types of financial models can be your edge in investment banking, equity research, or corporate finance.

If you’re looking to build a career in finance or elevate your analytical skillset, understanding the types of financial models is essential. And if you’re searching for the best financial modeling coaching in Delhi, look no further than Finaim—India’s fastest-growing institute for financial education.

🔍 What is Financial Modeling?

Financial modeling is the process of creating a spreadsheet-based tool to simulate a company’s financial performance. It helps in decision-making through forecasting revenues, costs, profitability, and valuation using key metrics and assumptions.

Think of it as the financial GPS—whether you’re investing, budgeting, raising capital, or doing M&A analysis, modeling keeps you on course.

🧠 Why Learn Financial Modeling?

Helps assess business viability

Crucial for investment decision-making

Enhances career opportunities in finance

Supports data-driven strategic planning

And the best part? You don’t need a finance degree to learn it—all you need is the right training and guidance, which is exactly what Finaim provides.

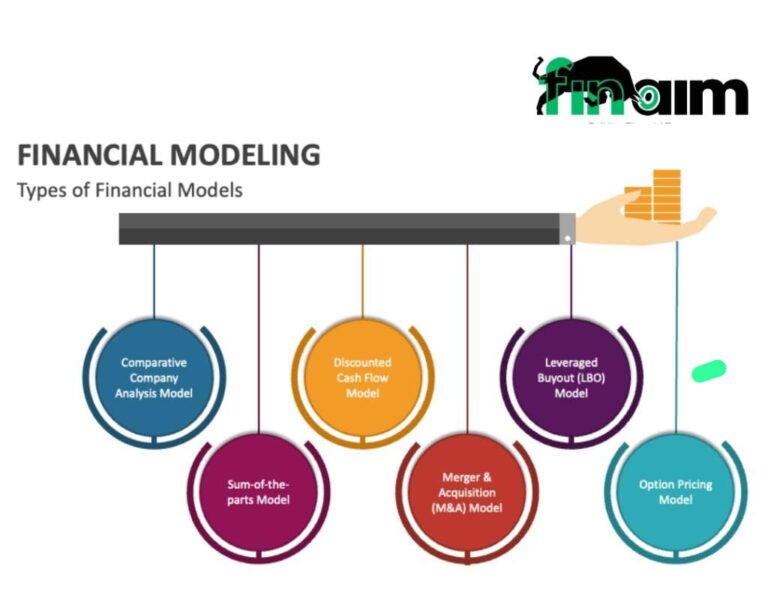

📊 Types of Financial Models You Must Know

As shown in the visual above, there are six core types of financial models that every finance professional should master. Let’s dive into each:

1. Comparative Company Analysis Model (Comps Model)

Used to evaluate a firm’s value relative to peers by comparing valuation multiples like EV/EBITDA, P/E ratio, etc. Perfect for equity research and investment banking.

2. Discounted Cash Flow (DCF) Model

One of the most widely used models. It calculates the present value of expected future cash flows. Ideal for intrinsic valuation.

3. Leveraged Buyout (LBO) Model

Common in private equity, this model shows how a company can be acquired using a significant amount of borrowed money. It focuses on debt repayment, IRR, and cash flow management.

4. Merger & Acquisition (M&A) Model

Used to analyze the impact of a merger or acquisition. This model includes accretion/dilution analysis, synergies, and deal structuring.

5. Sum-of-the-Parts (SOTP) Model

Breaks a business into segments and values each separately. Useful for conglomerates or diversified companies.

6. Option Pricing Model

Used to value derivatives or stock options using Black-Scholes or binomial methods. Ideal for portfolio managers and analysts in derivative markets.

Learn all of these and more at Finaim, the top-rated training center for financial modeling in Delhi.

🎯 Why Finaim is the Best Financial Modeling Coaching in Delhi

At Finaim, we don’t just teach—we mentor, guide, and transform careers.

✅ Key Features of Finaim:

Hands-on training with real-world case studies

Led by industry experts from investment banks and Big 4 firms

Certification aligned with international standards

100% placement assistance and resume building

Online + Offline batches available

Whether you’re a student, MBA aspirant, or working professional, Finaim helps you become job-ready in just a few weeks.

🌐 Boost Your Career With Financial Modeling

Mastering financial models is no longer optional—it’s a must-have skill for careers in:

Investment Banking

Private Equity

Equity Research

Corporate Finance

Consulting

With the financial world becoming increasingly data-driven, companies are actively seeking candidates who can build and analyze financial models with precision

🚀 Start Your Journey with Finaim Today!

If you’re serious about learning financial modeling from scratch or upgrading your finance game, Finaim is your best bet.

Visit us today or sign up for a demo class and take the first step toward becoming a financial modeling expert in Delhi.

🏆 Final Thought

In the competitive world of finance, your skills are your currency. Learning the right types of financial models through Finaim’s industry-driven approach gives you an unbeatable edge in interviews and real-world scenarios.

So, if you’re searching for “best financial modeling coaching in Delhi” or want to level up your financial career, Finaim is your gateway to success.

Visit: https://finaim.in/

FINAIM

ADDRESS: 3rd Floor, Phelps Building, 9 A, Block A, Connaught Place, New Delhi, Delhi 110001

PHONE NO: 087009 24049

To stay updated follow us on INSTAGRAM : FINAIM.IN