Exploring US CMA Job Roles: Unlocking Career Opportunities with FINAIM

The US CMA (Certified Management Accountant) designation is widely regarded as one of the most prestigious certifications in the world of finance and accounting. Whether you are looking to advance your career or kickstart a fresh journey in the financial industry, the US CMA offers a multitude of job roles, competitive salaries, and opportunities for growth. In this article, we will explore the top US CMA job roles in detail and why pursuing a career with FINAIM can be a game-changer for your professional future.

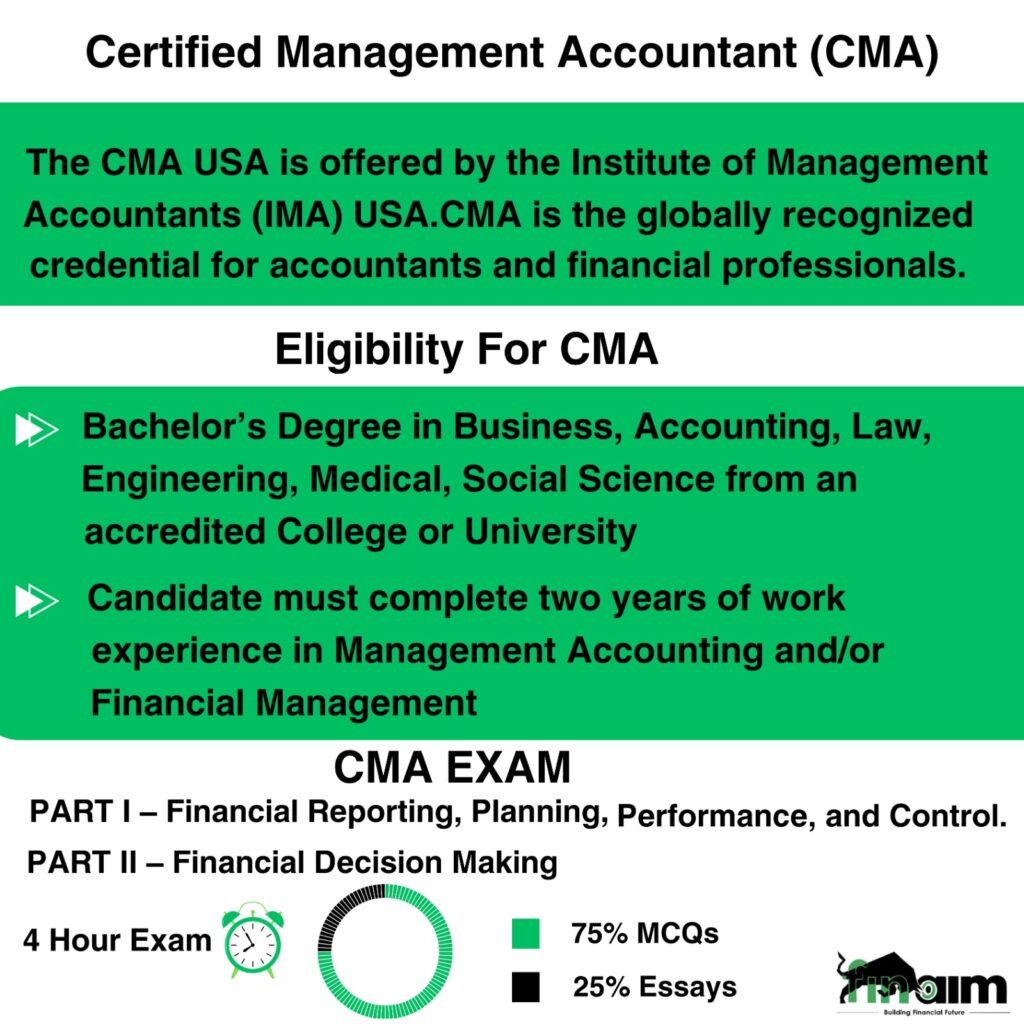

Before diving into the career opportunities available with a US CMA, it’s important to understand what the certification entails. The US CMA is awarded by the Institute of Management Accountants (IMA) and focuses on management accounting, financial management, and strategic management. It is a globally recognized credential that proves expertise in areas like financial planning, analysis, control, decision support, and professional ethics.

Obtaining a US CMA opens doors to a wide range of high-paying career paths and gives you an edge in a competitive job market. If you’re aiming for roles that involve strategic decision-making, risk management, or financial oversight, the US CMA is an excellent qualification.

High-Demand US CMA Job Roles

With a US CMA, professionals can explore several career paths in the finance and accounting domains. Below are some of the most sought-after roles:

- 1. Financial Analyst- As a Financial Analyst, you will be responsible for analyzing financial data, preparing reports, forecasting future financial trends, and providing insights to help companies make informed decisions. A US CMA adds significant value by enhancing your ability to interpret complex financial data, analyze profit margins, and recommend strategies for business growth.

- 2. Management Accountant- Management accountants focus on the internal financial processes of an organization, ensuring that financial data is accurate and used for strategic decision-making. A US CMA qualifies you for this role by honing your skills in budgeting, cost management, and financial planning, all of which are crucial to the efficient running of an organization.

- 3. Cost Accountant- Cost Accountants specialize in analyzing the costs of production and helping businesses reduce operational expenses. With a US CMA, you will have the expertise to oversee cost controls, manage inventories, and help companies improve their profitability by reducing unnecessary costs.

- 4. Internal Auditor- An Internal Auditor ensures that a company’s internal controls, accounting practices, and financial processes comply with industry standards and legal regulations. The US CMA provides a deep understanding of governance, risk management, and internal control frameworks, making you highly qualified for this role.

- 5. Financial Controller- Financial Controllers manage the financial health of an organization by overseeing financial reporting, budgeting, and compliance. With the expertise gained from a US CMA, you can efficiently supervise accounting teams, analyze financial reports, and ensure the accuracy of financial data, which are all key aspects of this role.

- 6. Chief Financial Officer (CFO)- The CFO is one of the highest-ranking executives responsible for overseeing a company’s financial operations. The US CMA designation is an excellent stepping stone toward this prestigious position, as it equips professionals with the strategic financial skills necessary to make high-level decisions and ensure the organization’s fiscal health.

- 7. Tax Manager- A Tax Manager is responsible for ensuring compliance with tax laws and regulations, and strategizing on tax-saving opportunities for a company. With a US CMA, professionals gain the knowledge required to navigate the complexities of tax accounting, thereby becoming more competitive in the field.

Career Growth and Salary Potential with US CMA

Salary Trends for US CMA Professionals

The salary potential for US CMA professionals varies based on the role, location, and level of experience. However, data suggests that US CMA professionals earn significantly higher than their non-certified counterparts. Here are some salary estimates for common roles:

- Financial Analyst: ₹6-10 Lakh per annum (India)

- Management Accountant: ₹8-14 Lakh per annum (India)

- Cost Accountant: ₹7-12 Lakh per annum (India)

- Internal Auditor: ₹8-15 Lakh per annum (India)

- Financial Controller: ₹12-25 Lakh per annum (India)

- CFO: ₹25-40 Lakh per annum (India)

The opportunities for career growth after earning a US CMA are abundant, especially when you partner with a reputed organization like FINAIM. FINAIM, known for its focus on excellence in finance and accounting, provides a wealth of opportunities for US CMA certified professionals to grow and develop their careers. Whether you’re interested in financial consulting, corporate finance, or management roles, FINAIM offers a conducive environment to accelerate your career.

Moreover, FINAIM’s broad network of clients across various industries opens the door to job roles in multinational corporations, helping US CMA professionals gain international experience.

Why Choose FINAIM for Your Career?

1. Global Recognition

FINAIM is recognized internationally for its expertise in financial services. Partnering with a global player in the finance industry allows you to gain exposure to the best practices, tools, and technologies in the sector.

2. Comprehensive Learning and Development

At FINAIM, career development is a continuous process. The company provides its employees with a wide range of training opportunities, helping you stay ahead in the constantly evolving finance landscape. This is especially valuable for US CMA professionals looking to climb the corporate ladder.

3. Diverse Job Roles

As a US CMA, you have the chance to explore multiple job roles within FINAIM, whether you’re interested in technical financial roles or strategic managerial positions. The diversity of opportunities allows you to tailor your career path according to your strengths and aspirations.

4. Competitive Salaries and Benefits

FINAIM offers attractive compensation packages and benefits, which are in line with industry standards. As a US CMA, you will have the advantage of securing competitive salaries that reflect your skills and expertise in the finance domain.

How to Get Started with US CMA?

Getting started with a US CMA requires dedication and focus. Here are a few steps to help you on your journey:

Register with IMA: The first step is to become a member of the Institute of Management Accountants (IMA), the body that awards the US CMA.

Prepare for the Exams: The US CMA exam consists of two parts: Part 1 (Financial Reporting, Planning, Performance, and Control) and Part 2 (Financial Decision Making). You can prepare for these exams through online courses, study materials, and coaching classes.

Gain Work Experience: To be eligible for certification, you need at least two years of professional experience in management accounting or financial management.

Pass the Exams: Once you pass both parts of the exam and meet the experience requirement, you will earn the US CMA certification.

Conclusion

The US CMA certification is a powerful tool for anyone looking to advance their career in finance and accounting. With diverse job roles, competitive salaries, and opportunities for growth, the US CMA is a valuable investment in your professional future. And with the backing of a global leader like FINAIM, your career can reach new heights, offering exciting prospects in both national and international markets.

If you’re ready to take the next step in your career, earning a US CMA with FINAIM can set you on a path to success.