Understanding the US CMA Exam Structure: A Complete Guide for Aspiring Candidates

The US CMA (Certified Management Accountant) certification is one of the most prestigious credentials for professionals in the field of management accounting and financial management. If you’re aiming to elevate your career in the world of finance, the US CMA is a pathway that can help you unlock numerous opportunities.

In this guide, we’ll dive into the US CMA exam structure, providing a clear, comprehensive overview to help you understand what to expect. Whether you’re preparing for the exam or just exploring the possibilities, this blog will give you all the information you need to make the process smoother.

At FINAIM, we are committed to providing high-quality financial education that supports your journey toward the US CMA certification. Let’s break down the US CMA exam structure and other essential details to help you succeed.

What is the US CMA Certification?

Before we explore the exam structure, let’s first understand what the US CMA certification entails. The CMA exam is designed for professionals who want to specialize in management accounting and financial management. It is recognized globally and is administered by the Institute of Management Accountants (IMA) in the United States.

Earning the CMA designation demonstrates your expertise in areas such as financial planning, analysis, control, decision support, and professional ethics.

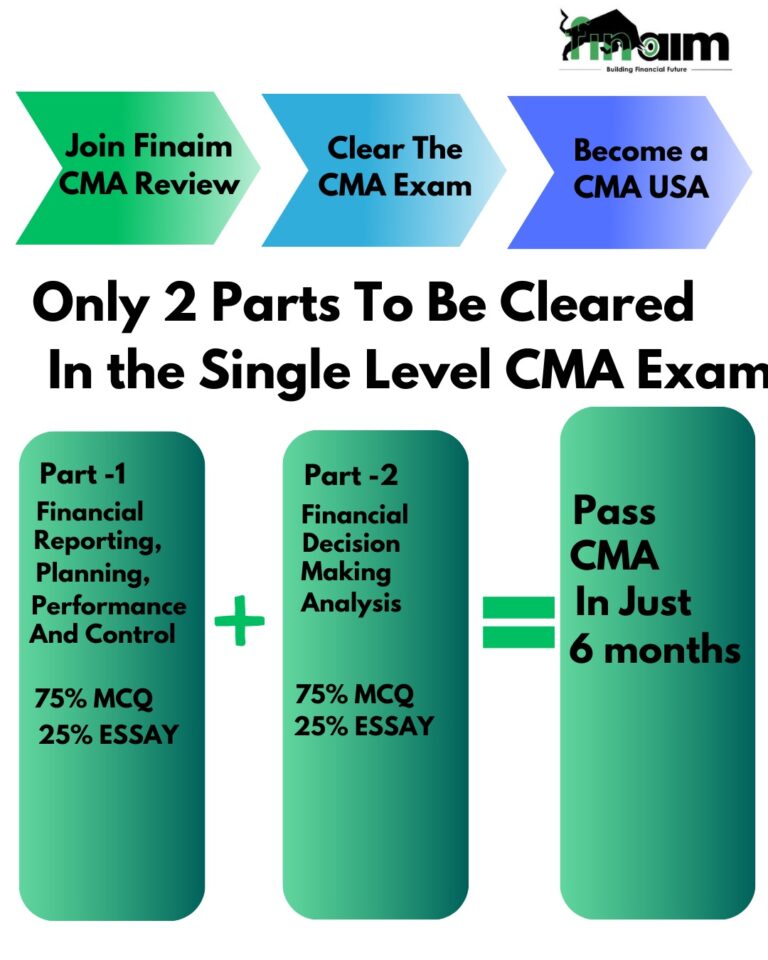

US CMA Exam Structure: Overview

The US CMA exam is divided into two parts, each focusing on distinct areas of management accounting and financial management. Here’s a quick breakdown of the US CMA exam structure:

Part 1: Financial Reporting, Planning, Performance, and Control

Part 1 of the US CMA exam covers the foundational elements of financial management, focusing on topics like:

- External Financial Reporting Decisions: The principles behind preparing and presenting financial statements.

- Planning, Budgeting, and Forecasting: Techniques for developing budgets and making projections.

- Performance Management: Methods to evaluate performance and enhance operational efficiency.

- Cost Management: Understanding different cost structures and methods used for cost control and analysis.

- Internal Controls: Measures for safeguarding company assets and ensuring compliance with regulations.

The exam for Part 1 consists of 100 multiple-choice questions (MCQs) and two essay questions, allowing candidates to apply theoretical knowledge to real-world scenarios.

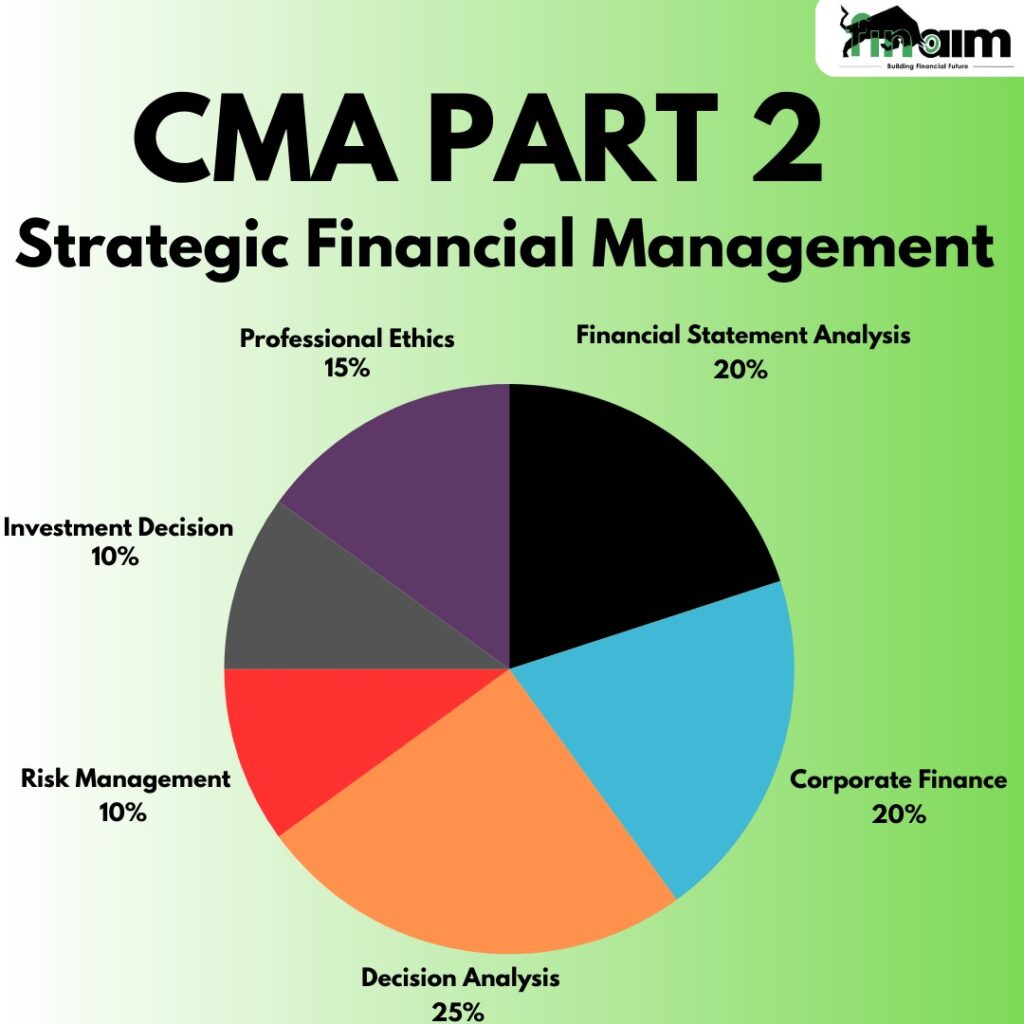

Part 2: Financial Decision Making

Part 2 of the US CMA exam delves into more advanced financial management concepts. It focuses on decision-making processes that help organizations make informed financial choices. Key topics include:

- Financial Statement Analysis: Techniques for analyzing the financial health of a company using key ratios and other metrics.

- Corporate Finance: Topics such as risk management, capital budgeting, and working capital management.

- Decision Analysis: Methods to assess financial decisions, including cost-benefit analysis and risk assessment.

- Risk Management: Identifying, managing, and mitigating financial risks that could impact business operations.

- Investment Decisions: Understanding various investment strategies and how they align with organizational goals.

Part 2 consists of 100 multiple-choice questions and two essay questions, much like Part 1. However, the content in this part is more complex and requires a deeper understanding of financial strategy.

US CMA Exam Format and Duration

Each part of the US CMA exam consists of the following:

- 100 Multiple-Choice Questions (MCQs): These are designed to test your knowledge and understanding of core topics in management accounting and financial management.

- 2 Essay Questions: These questions require you to apply your knowledge in real-world scenarios and demonstrate problem-solving skills.

The total time for each part of the US CMA exam is 4 hours:

3 hours for the MCQs

1 hour for the essay questions

Exam Scoring and Passing Criteria

The US CMA exam is scored on a scale of 0 to 500, with a passing score set at 360 for each part. This means that you need to achieve at least a score of 360 to pass each section. Your score will be based on the correct answers in the MCQ section, as well as the quality and accuracy of your responses in the essay section.

If you don’t pass the exam on the first attempt, you can retake the section within the validity period (3 years) of your CMA program. FINAIM offers comprehensive resources to help you prepare and succeed on your first attempt.

US CMA Eligibility Criteria

To be eligible for the US CMA exam, candidates must meet the following requirements:

Education: A bachelor’s degree or its equivalent from an accredited institution.

Professional Experience: A minimum of two years of professional experience in management accounting or financial management. However, this requirement can be fulfilled before or after passing the exam.

IMA Membership: You must be a member of the Institute of Management Accountants (IMA) to sit for the exam.

It’s important to note that while the US CMA exam can be taken before completing the professional experience, the certification will only be awarded once all requirements, including experience, are fulfilled.

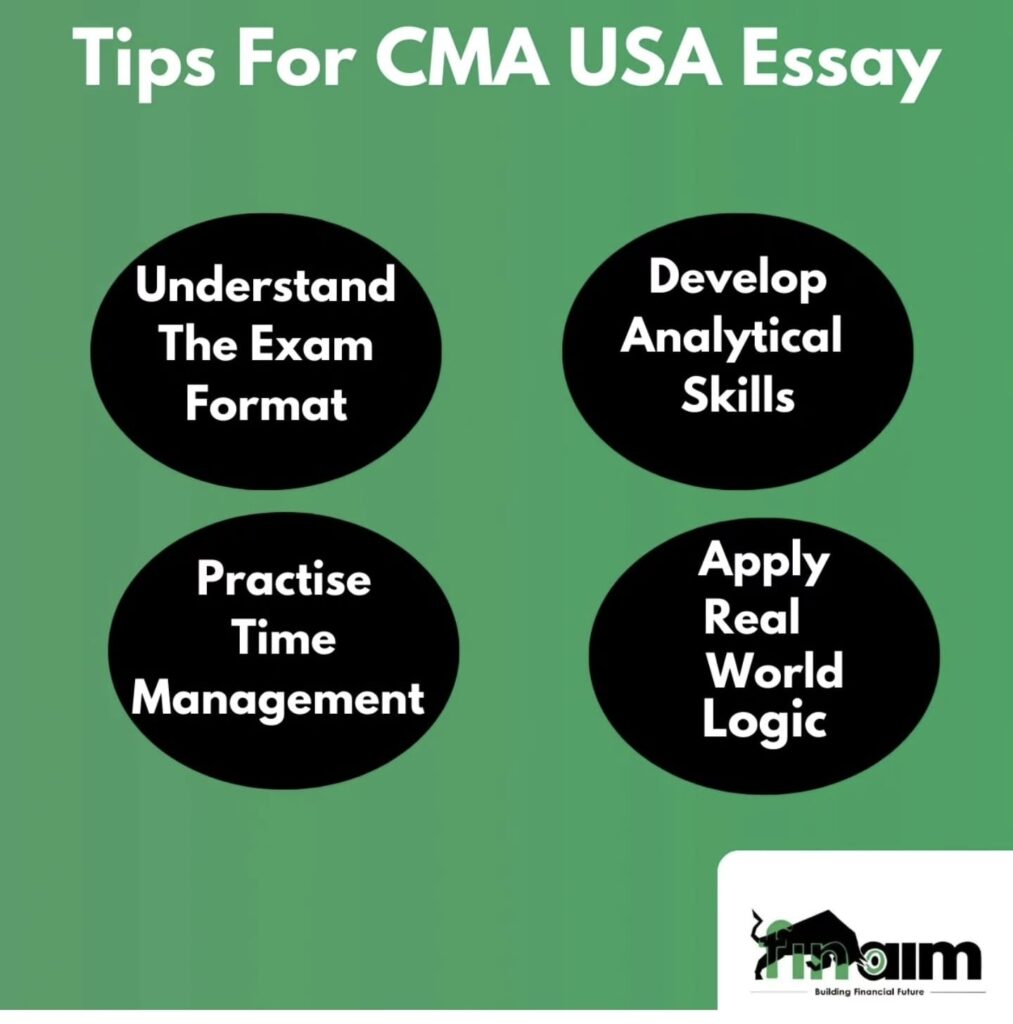

Preparing for the US CMA Exam: Tips for Success

Preparing for the US CMA exam can be challenging, but with the right approach and resources, success is within reach. Here are some tips to help you get started:

1. Create a Study Plan

The US CMA exam covers a wide range of topics. Having a well-structured study plan is crucial to ensure you cover all the material in time. Divide your study time between MCQs and essay questions, ensuring that you give ample focus to both.

2. Use Reliable Study Materials

At FINAIM, we provide high-quality resources, including study guides, practice exams, and video tutorials, to help you prepare effectively for the exam. Make sure to use resources that align with the US CMA exam structure to ensure a focused and targeted study session.

3. Practice with Sample Questions

Regularly practicing sample questions is one of the most effective ways to get accustomed to the exam format. Try to solve multiple practice tests to familiarize yourself with the exam structure and improve your time management skills.

4. Stay Updated on Exam Changes

The exam format and content can change from time to time. Stay updated with any changes by visiting the official IMA website or following reliable financial education sources like FINAIM.

5. Join a Study Group

Consider joining a study group or online community of US CMA candidates. This provides you with an opportunity to discuss difficult topics, share resources, and stay motivated.

Why Choose FINAIM for Your US CMA Journey?

At FINAIM, we understand the challenges involved in preparing for the US CMA exam. That’s why we offer specialized courses, expert-led coaching, and personalized guidance to help you navigate the exam structure with ease. Whether you’re just starting your CMA journey or preparing for your final exam, we provide all the resources you need to succeed.

Our Key Offerings:

Comprehensive Study Material: Tailored resources covering every part of the exam.

Expert Guidance: Learn from professionals who understand the nuances of the US CMA exam.

Mock Tests & Practice Papers: Real-time practice tests to evaluate your progress.

Personalized Coaching: One-on-one coaching sessions for focused exam preparation.

Final Thoughts

The US CMA exam is a challenging yet rewarding journey for anyone looking to advance in the field of management accounting and financial management. By understanding the US CMA exam structure and following the right preparation strategies, you can achieve success and earn a globally recognized certification that will elevate your career.

If you’re serious about passing the US CMA exam, FINAIM is here to guide you every step of the way. Start preparing today, and unlock new career opportunities with the prestigious US CMA designation.

FOR MORE INFO

VISIT: https://finaim.in/cma-course-in-delhi/

FINAIM

ADDRESS: 3rd Floor, Phelps Building, 9 A, Block A, Connaught Place, New Delhi, Delhi 110001

PHONE NO: 087009 24049