The Best Courses After US CMA for a Thriving Career - FINAIM

Are you a US CMA (Certified Management Accountant) and wondering what’s next in your career? Congratulations on achieving this globally recognized credential! But if you’re looking to expand your career opportunities, enhance your expertise, and increase your earning potential, pursuing further professional qualifications could be a game-changer.

In this blog, we’ll explore the top courses after US CMA that can elevate your career, making you a sought-after finance and accounting professional. Whether you want to dive deeper into financial management, investment analysis, or auditing, there are multiple options to consider. Let’s explore them in detail.

Why Pursue Further Courses After US CMA?

The US CMA certification equips professionals with advanced management accounting knowledge. However, if you aim for leadership roles or specialized areas like investment banking, auditing, or financial planning, additional certifications can help you stand out.

Here’s why pursuing further education or certification after US CMA is beneficial:

Career Growth – Enhance your expertise and qualify for senior-level roles.

Higher Salary Potential – Professionals with multiple certifications earn significantly more.

Global Opportunities – Gain international recognition and job mobility.

Diverse Career Paths – Open doors to fields like investment management, financial analysis, and auditing.

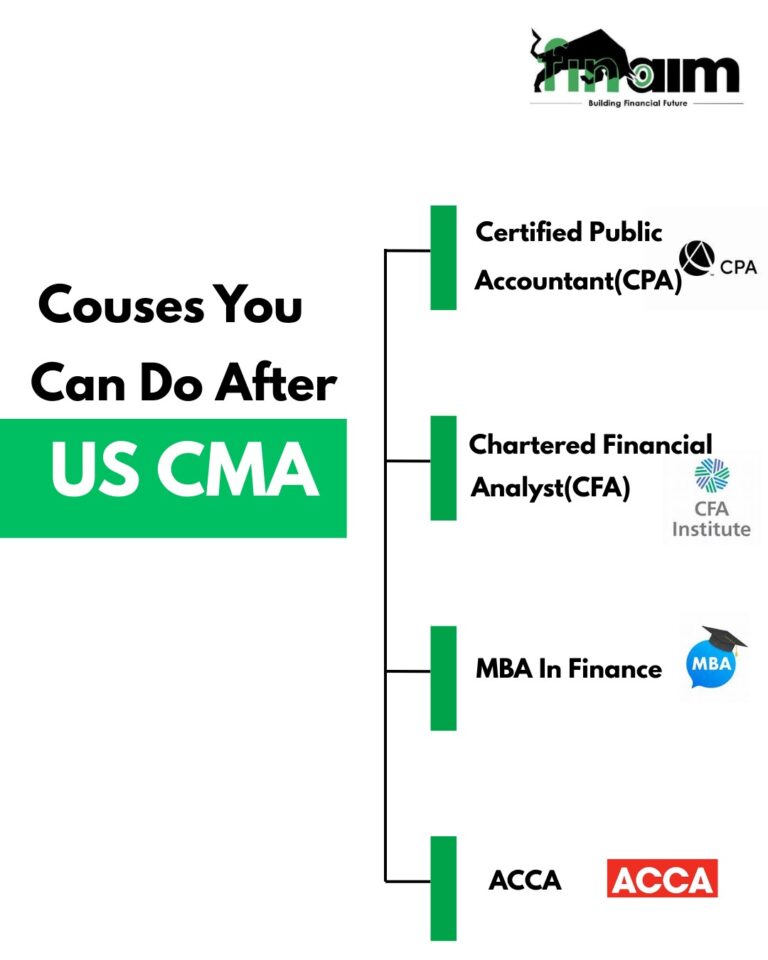

Top Courses to Pursue After US CMA

1. Certified Public Accountant (CPA)

The CPA (Certified Public Accountant) is an excellent choice after US CMA. If you’re looking for a career in public accounting, auditing, taxation, or financial consulting, this is the perfect qualification.

Why Choose CPA After US CMA?

✅ Recognized globally, especially in the USA, Canada, and Australia. ✅ Strong demand in accounting firms, financial consulting, and taxation. ✅ Higher earning potential compared to standalone CMA holders.

Eligibility & Duration

Typically requires a bachelor’s degree in accounting or finance.

Can be completed within 12-18 months.

2. Chartered Financial Analyst (CFA)

The CFA (Chartered Financial Analyst) certification is highly respected in the investment world. If you are keen on a career in investment banking, portfolio management, risk analysis, or asset management, CFA is the best course after US CMA.

Why Choose CFA After US CMA?

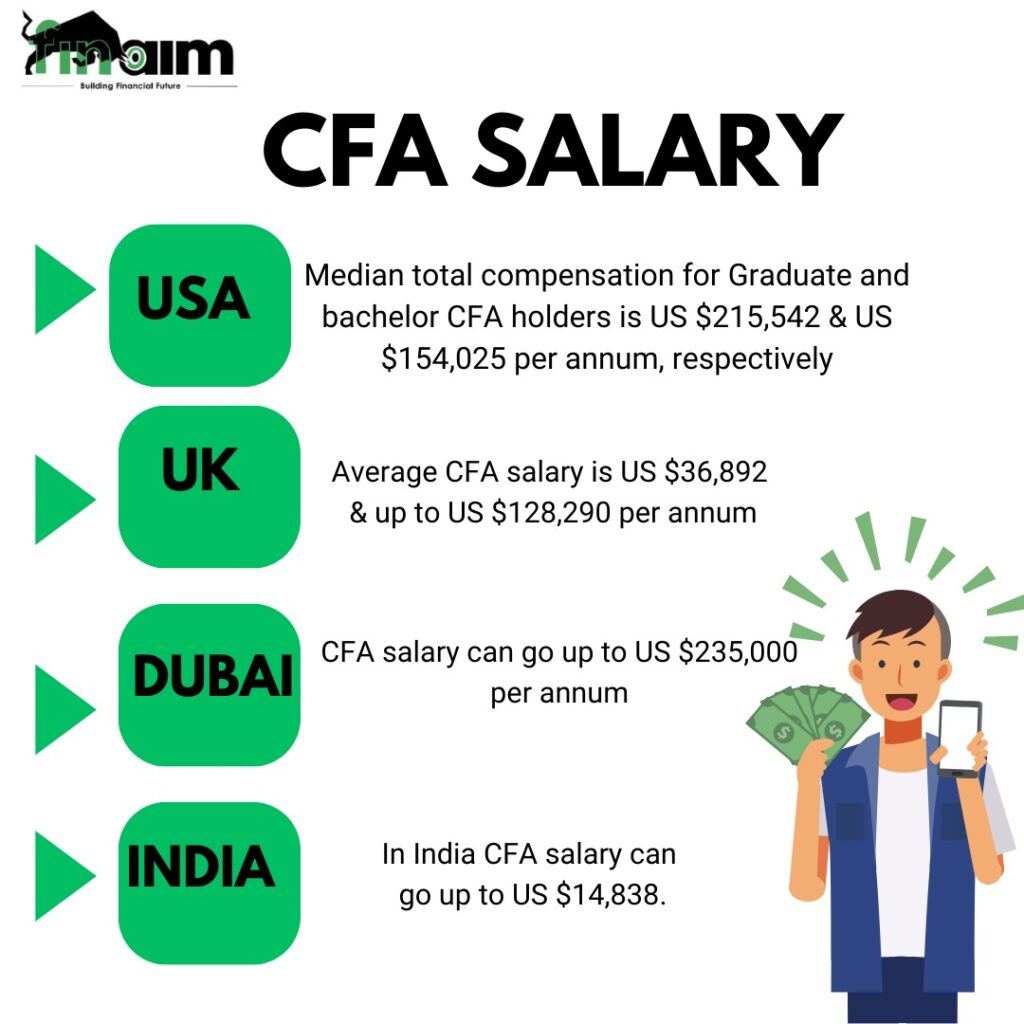

✅ Globally recognized credential in investment management and financial analysis. ✅ High demand in hedge funds, investment banks, and asset management firms. ✅ Significantly boosts earning potential, especially in finance and banking.

Eligibility & Duration

Requires a bachelor’s degree.

Has three levels, and typically takes 2-3 years to complete.

3. MBA in Finance

An MBA in Finance is a great way to develop leadership and strategic skills. If you aim for executive-level positions in corporate finance, banking, or financial consulting, this is a solid option.

Why Choose an MBA After US CMA?

✅ Expands career opportunities in corporate leadership and financial management. ✅ Opens doors to high-level executive positions (CFO, Finance Director, etc.). ✅ Enhances strategic thinking and business acumen.

Eligibility & Duration

Requires a bachelor’s degree.

Takes 1-2 years (full-time) or 3-4 years (part-time/online).

4. Association of Chartered Certified Accountants (ACCA)

If you’re looking for an international accounting qualification, ACCA is a great choice. This certification is ideal for professionals targeting corporate finance, taxation, and financial management roles in Europe, the UK, and Asia.

Why Choose ACCA After US CMA?

✅ Recognized in over 180 countries, making it a great option for international career growth. ✅ Broadens expertise in financial reporting, taxation, and business law. ✅ High demand in multinational corporations and financial services.

Eligibility & Duration

Open to those with a background in accounting or finance.

Takes 2-3 years to complete.

Final Thoughts: Elevate Your Career with FINAIM

Choosing the right course after US CMA can significantly boost your career growth. Whether you opt for CPA, CFA, MBA, or ACCA, each qualification adds substantial value to your profile. If you’re serious about advancing in the finance and accounting industry, now is the time to take action!

At FINAIM, we help aspiring finance professionals navigate the best career paths and professional certifications. Whether you need career guidance, exam preparation tips, or mentorship, we’ve got you covered.

🚀 Get started today and take your career to the next level with FINAIM!

FOR MORE INFO VISIT:

FINAIM

ADDRESS: 3rd Floor, Phelps Building, 9 A, Block A, Connaught Place, New Delhi, Delhi 110001

PHONE NO: 8700924049

Frequently Asked Questions (FAQs)

1. Is it necessary to pursue another course after US CMA?

No, but if you want to specialize in areas like investment banking, auditing, or corporate finance, further certifications can boost your career opportunities.

2. Which is better after US CMA: CPA or CFA?

It depends on your goals. CPA is best for auditing and taxation, while CFA is ideal for investment management and financial analysis.

3. Can I do an MBA after US CMA?

Yes! An MBA in Finance is an excellent choice for leadership roles in corporate finance and banking.

4. Is ACCA a good choice after US CMA?

Yes, if you’re looking for international accounting opportunities, ACCA is highly recognized globally.